03.04

Share ArticleWeekend Forex: An Opportunity to Trade or Stay Away

The Forex market is known to operate 24 hours a day on weekdays from Sunday evening to Friday evening. Large banks and institutional traders, which account for 93% of the total trading volume, work only on weekdays and take a break on weekends.

Forex on weekends

However, just because the market is off doesn't mean you have not to work too. In fact, weekends are a good opportunity for traders to reflect and plan for the upcoming trading week. Some traders even prefer to trade on the weekend and open positions on Saturday and Sunday rather than during the week. In this article, we will take a closer look at weekend trading and see if it is worth trying it or not.

Is it possible to trade on the weekend

Technically, some trading can be done on weekends due to time zone differences around the world, but that's not the point of weekend trading. Weekend trading is the ability to open trades on Saturday or Sunday. This means that you don't have to wait for the markets to open to make a trade.

Most markets are closed on weekends, but some remain open. The assets that are most often traded on weekends are indices and cryptocurrencies. As for Forex broker trading, depending on the broker, options are usually limited to major pairs such as EUR/USD, GBP/USD and USD/JPY. It is also worth noting that in some special cases, wealthy individuals can trade with a broker on weekends. This usually happens if a trader is expecting important news to be released over the weekend or to cover a position taken during the week.

How to trade on weekends

While it is possible to trade on the weekend, most traders choose not to do so and wait for the major markets to open on Monday. Here are a few reasons why you should avoid trading on the weekend:

Higher spread

Brokers that offer weekend trading usually set much higher spreads than they do on weekdays. This reason alone is enough to make you reconsider trading on weekends.

Low liquidity

Most traders do not trade on weekends, so market liquidity is usually very low. This means that your trades will not be executed as accurately as they are on weekdays.

Limited market opportunities

As mentioned above, most markets are closed on weekends. Brokers that offer weekend trading usually limit their markets to make it easier to manage risk. This leaves traders with fewer opportunities to make profits.

Limited number of brokers

Not all brokers offer weekend trading due to low demand and incredibly high costs. Keep in mind that opening markets on weekends means hiring more people to monitor the situation, as well as additional costs associated with infrastructure such as electricity, communication line, etc. Most brokers do not find this favorable and therefore prefer not to offer weekend trading.

Weekend gap risk

Between the close of trading on Friday and the opening of trading on Sunday, there is often a significant difference in price, also called a gap. Gaps can move prices in either direction, so they can increase both your potential profit and risk. If you're not careful, price gaps can lose you a lot of money in just a few days.

Weekend trading opportunities

If you can't bear a day or two without trading, even on the weekend, you can use this time to plan your next trade. In fact, the weekend is the perfect time to analyze your past results and prepare for the next one.

During the week, most retail traders are busy with their lives and work. They have very little time to follow charts and catch up on market news. Moreover, not everyone can afford to pay someone to manage trades in their absence. Therefore, weekends are a great opportunity to spend more time studying charts, current market trends and so on.

In addition, weekends are also a good time to practice or test your strategies. A demo account is very useful in this situation, as it allows you to make trades without risking real money. You may even find it easier to analyze charts and draw conclusions on the weekend, as the market is calmer. All in all, it's a great way to dive headfirst into the week ahead.

Niall Fuller

Niall Fuller is a price action expert with over 15 years of experience who truly believes in the power of analyzing the market over the weekend. In his opinion, the best time to perform market analysis and make trading decisions is when the markets are closed. Instead of frantically checking charts throughout the week and ending up making terrible market decisions, it is much more effective to do your basic market analysis on weekends and only occasionally monitor the market on weekdays.

The advantages of this approach

First, it saves a lot of time because you are only doing in-depth analysis over the weekend. The charts you see during the weekend are also very important, even more important than the ones you see during the week, because they contain information about the whole week, showing who won the battle between bulls and bears. In addition to this, this method is also a very good approach to low-frequency trading. It will help you earn more by trading less and will improve your performance in the long run.

Fuller's Plan of Action

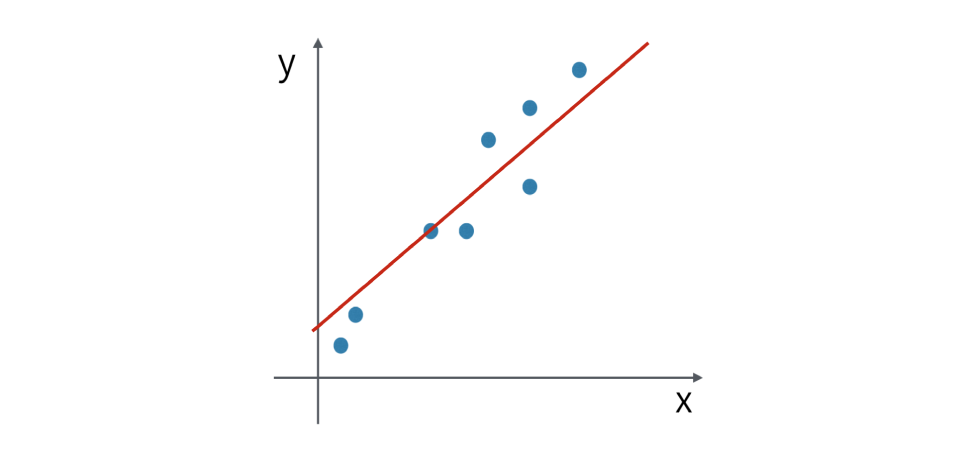

The first thing to do is to open the charts and study the weekly timeframe to identify key support and resistance levels, highs and lows, event zones and action signals on the daily charts. This is important to get a good overview of the long-term market trend. Note all key levels as well as the trend (bullish or bearish) and chart condition (bullish, bearish or sideways).

The next thing to do is to analyze the chart on a daily timeframe. To analyze the chart you need to:

- Draw any obvious support and resistance levels that may not have been visible on the weekly chart;

- Identify the short-term trend on the daily chart to decide which way you will trade next week;

- Look for any obvious price action signals for potential entries.

Pros of this method

By using this method, you will get an idea of how prices may move in the coming weeks. You can use your analysis as a guide for your next trades in the near future. Keep in mind that weekly and daily timeframes are just as important for making trading decisions. For example, if the daily chart is moving sideways, you need to look to the weekly chart to determine the direction of your next trade. If it is an uptrend, look for long positions. If it is a downtrend, however, look for short sales.

Also, if there are signals from Friday's close, you can plan your trade for next Monday. If there is nothing yet, you will have to wait for the daily chart to give you something useful for next week.

Let's summarize

Trading on weekends is quite possible, but it is not always recommended for every trader. Many factors make it less profitable than weekday trading, such as wider spreads, lack of liquidity, limited market opportunities and so on. Therefore, instead of forcing yourself to trade in unfavorable conditions, it is better to use this time to evaluate your trades and plan your strategy for the next week.

Reviews