09.01

Share ArticleCurrency or stock markets: what's the difference

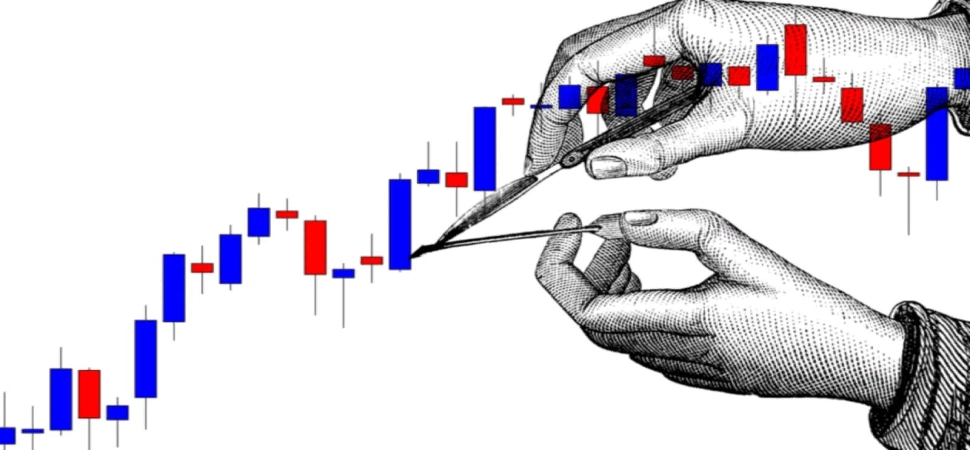

The financial markets offer many investment opportunities, but the two most commonly considered options are the Forex currency market and the stock market. These two markets have their own characteristics and understanding their differences is essential to the trading strategy of any investor looking to diversify their portfolio.

Forex and Stock Market

The foreign exchange market, or Forex, is where trading of different currencies takes place. Forex transactions are always done in pairs, with one currency being bought and the other sold at the same time. Currencies are valued against each other. The main currency pairs currently traded on the Forex market include EUR/USD, USD/JPY and GBP/USD. Forex is the world's largest market, with a daily trading volume of several billion dollars.

The stock market, or equity market, on the other hand, involves buying and selling shares of listed companies. By purchasing these shares, investors become owners of a portion of the company with the possibility of their shares rising or falling in value. Trading in the stock market involves buying shares with the intention of selling them after a change in value.

Fundamental differences

Whether you choose to invest in forex or stocks depends on which asset you plan to trade. There are a number of differences between the two markets that will help you choose the best trading strategy.

Market risks and volatility

The foreign exchange market is often considered more volatile due to constant international trade and global economic events. Exchange rates can fluctuate dramatically in response to unexpected news. This creates both opportunities and potential risks for investors.

While stocks can be just as volatile, they tend to be more stable over the long term. Equity investors can see fluctuations in the value of their investments, but the economic cycles of companies are often slower than those of currencies.

Trading hours

Forex operates 24 hours a day, five days a week, providing the opportunity to trade at any time. Stock markets have more specific trading hours, usually coinciding with the opening hours of the world's major stock exchanges. This means that trading opportunities are more limited in time.

Liquidity and leverage also need to be considered when understanding the nuances of each market.

How to invest

Forex trading inevitably involves accessing an online platform through a broker. Investing in the stock market, on the other hand, can be done either through a bank or a specialized broker.

In terms of investment strategies, investing in the foreign exchange market offers many short-term opportunities, such as day trading, scalp trading and swing trading. Equity investors, on the other hand, can take a medium to long-term approach by investing in successful companies.

The choice between forex and stocks depends on each investor's personal preferences, investment goals and risk tolerance. Some prefer diversification, combining both types of investments, while others specialize in one or the other according to their knowledge and trading strategies.

Conclusion

The currency market and the stock market have their advantages and disadvantages. Choosing a market depends on many factors: when you want to trade, how much risk you are willing to take and how much long-term trading you are interested in.

Understanding these aspects will not only help you choose a market to trade, but will also help you better understand yourself as a trader. In addition, you can always split your investment and try your hand at both forex and stock market.

Reviews