01.04

Share ArticleKey aspects of correlation analysis in the Forex market

Knowing how currencies are correlated is important in understanding how the forex market works. Correlations are influenced by many factors such as economic fundamentals, geopolitical events, market sentiment and monetary policy. Traders can manage risk, diversify their investments, and create solid trading plans by recognizing and studying these correlations.

Currency Correlations

Currency pairs often have strong positive or negative correlations based on the relationship between their respective economies. For example, EUR/USD and GBP/USD pairs usually have a strong positive correlation because the Eurozone and UK economies are closely linked.

Conversely, USD/CHF and EUR/USD pairs have a strong negative correlation because the Swiss franc is often seen as a safe haven currency and tends to rise in value when the euro or the US dollar falls.

Correlation with commodities

The currencies of countries that are major producers or consumers of commodities often show a strong correlation with commodity prices.

The Canadian dollar (CAD), Australian dollar (AUD) and New Zealand dollar (NZD) are commonly referred to as "commodity currencies" because their economies rely heavily on natural resource exports.

For example, the Canadian economy is closely linked to oil prices, so the CAD/USD pair tends to be positively correlated with oil prices.

Risk appetite

During periods of market uncertainty or volatility, investors often shift their capital from riskier to safer assets, which can create correlations between currency pairs.

The Japanese yen (JPY), Swiss franc (CHF), and U.S. dollar (USD) are considered safe haven currencies because they attract capital during periods of market stress.

Conversely, currencies such as the Australian dollar (AUD), New Zealand dollar (NZD) and South African rand (ZAR) are often viewed as riskier assets and can have a negative correlation with safe haven currencies during periods of market turbulence.

This is because these currencies are often dependent on commodity exports, which are pro-cyclical, or have higher credit risk (e.g. emerging market currencies).

Interest rate correlation

Central bank monetary policy, particularly interest rates, can have a significant impact on currency correlation. When a central bank raises interest rates, currencies tend to appreciate, attracting foreign capital and increasing demand.

Conversely, when a central bank lowers interest rates, the currency may weaken. For example, if the European Central Bank (ECB) raises interest rates more than markets expect and the U.S. Federal Reserve holds rates, the EUR/USD currency pair may come under upward pressure.

Correlations between inflation and economic growth

Currency pairs can also show correlations based on the economic performance of the respective countries. Inflation and economic growth are two key indicators that can affect the value of a currency (as well as any asset class). For example, if inflation in the U.S. is growing faster than in the Eurozone, the dollar may weaken against the euro, causing the value of the EUR/USD currency pair to rise.

Political Correlations

Political events and changes in government policy can create correlations between currency pairs. Elections, referendums and geopolitical tensions can lead to market uncertainty and currency volatility. For example, Brexit led to large swings in GBP/USD and EUR/GBP currency pairs as investors began to question the future relationship between the UK and the EU.

Timing

Correlations in the currency market can vary depending on the time period being analyzed. Short-term correlations can be influenced by market events or news, while long-term correlations are likely to be driven by economic fundamentals. Traders should consider both short-term and long-term correlations when developing their trading strategies.

Correlations between markets

Forex market correlations can also depend on correlations with other financial markets such as stocks, bonds and commodities. For example, a strong performance in the stock market can stimulate investors' appetite for risk, leading to a sell-off in safe-haven currencies and an increase in demand for riskier currencies. Similarly, rising bond yields can attract foreign capital and affect the valuation of currencies.

Correlations between currency indices

Another way to analyze correlations in the foreign exchange market is to examine the relationship between currency pairs and their respective indices. Currency indices such as the US Dollar Index (DXY) or the Euro Index (EXY) can provide valuable insight into the overall strength or weakness of a currency, which can then affect its correlation with other currency pairs.

Diversification and portfolio management

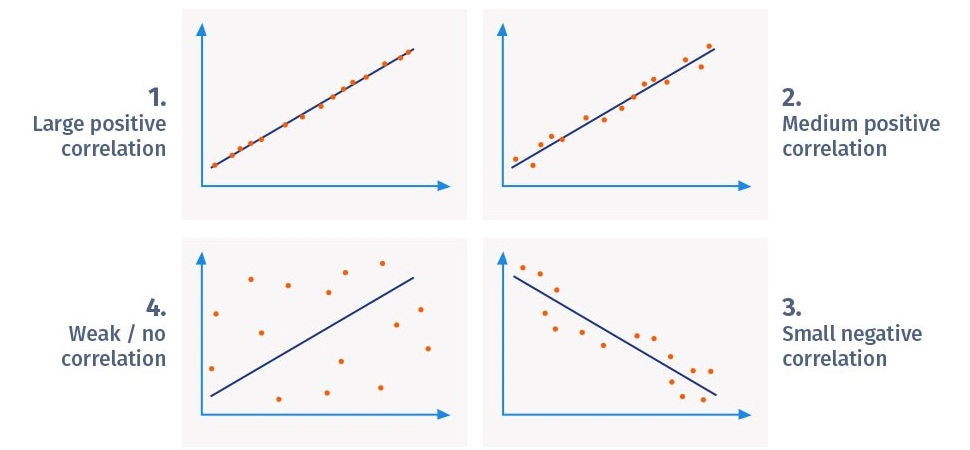

Understanding correlations in the currency market is essential for managing risk in a trading portfolio. Highly correlated currency pairs can lead to risk concentration as they often move in the same direction.

By including negatively correlated or uncorrelated currency pairs in a trading portfolio, traders can diversify their risk and potentially increase returns.

Changing correlations

As mentioned above, correlations between currencies are not static and can change over time due to economic conditions, market sentiment and geopolitical events. Traders should regularly monitor and update correlation analysis to ensure their strategies remain relevant and effective.

Tools for analyzing currency correlation

There are a number of tools and resources available to help traders analyze correlations in the Forex market. Online platforms and charting software typically offer correlation matrices that display the correlation coefficients between different currency pairs over a specific period.

This information can help traders identify potential opportunities and manage risk more effectively.

Analyzing correlations in the currency market requires a thorough understanding of the many factors that influence the relationship between currency pairs. By taking into account aspects such as currency ratios, commodity prices, risk appetite, interest rates, inflation, economic growth, political events, market relationships, currency indices, diversification and the evolution of correlations, traders can gain a clear understanding of the interconnected dynamics of the currency market.

This knowledge can then be applied to improve trading strategies and overall performance.

Understanding correlations in the currency market can be a valuable tool for traders to manage risk, diversify portfolios, and develop more sophisticated trading strategies. By monitoring the factors that influence these correlations and understanding how they change over time, traders can make more informed decisions and improve overall trading performance.

Reviews