11.07

Share ArticleForex Scalping: Discover the secrets of successful trading

Understanding scalping

Forex scalping is a dynamic trading strategy in the foreign exchange market, characterised by fast paced and frequent trades. Unlike traditional trading methods, scalping involves making multiple trades within a single day in order to capitalise on small short-term market fluctuations.

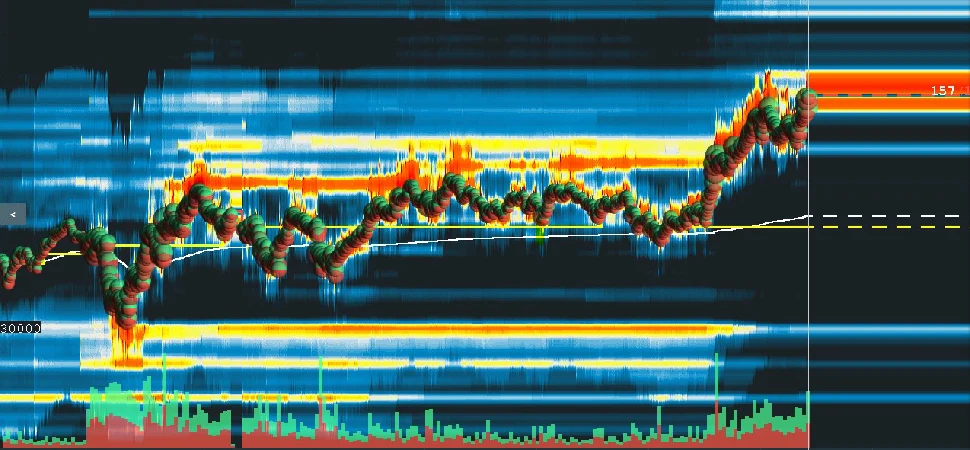

The essence of Forex scalping is to make a large number of trades, each of which lasts only a few minutes or even seconds. This strategy is based on technical analysis and quick reaction to market changes. Scalpers use a variety of tools such as moving averages, stochastic oscillators and candlestick patterns to identify immediate buy or sell opportunities. The most important part of scalping is the ability to act quickly and decisively, making small profits that accumulate over the course of a trading day and turn into significant gains.

Is scalping right for you?

Determining whether Forex scalping fits your trading style involves assessing various personal qualities and preferences. Scalping is not just a strategy, it is a fast-paced trading style that requires certain characteristics:

- Survival under pressure: You must be someone who works in a high-pressure environment and can make quick and accurate decisions without succumbing to stress;

- High level of concentration: Scalpers must monitor many charts and indicators simultaneously and react instantly to sudden market movements;

- Discipline and Structure: Successful scalping is based on strict adherence to strategy and risk management rules. Discipline is paramount, as is the ability to stick to your trading plan without giving in to emotion;

- Agility and Adaptability: Traders must be nimble, quickly adapting strategies to current market conditions and sentiment;

- Technology savvy: A good knowledge of trading platforms and tools is a must. Scalping involves frequent use of sophisticated charting software and trading tools for analysis and execution;

- Understanding of market nuances: Scalping requires not only technical analysis, but also awareness of news events, economic releases and other fundamental factors that can cause rapid changes in the market;

- Patience and perseverance: Despite its fast nature, scalping requires patience. It is about waiting for the right conditions to enter a trade and remaining calm throughout the trading session;

- Physical and mental stamina: Scalping can be mentally and physically demanding, requiring hours of hard work without significant breaks. It requires both mental and physical toughness;

- Risk tolerance: High-frequency trading involves a greater number of trades and therefore potentially greater risk. Assess your comfort level with risk and the fast pace of multiple trades;

- Seeking constant learning: Constantly refining your strategies, keeping up with market changes and learning from successes and failures are all vital to a scalper's growth and profitability.

Is scalping profitable?

The profitability of Forex scalping is the subject of much debate. Whilst it offers the potential to generate significant income through small but frequent profits, it also carries inherent risks and requires strict discipline and risk management. Successful scalping requires consistent performance, flexibility in adapting strategies and an understanding of market indicators. The key to profitability lies in maintaining control over a large number of trades and ensuring that the cumulative profits from successful trades outweigh the losses. Forex scalping is characterised by high speed and high trading volume, which requires special skills and mindset. While it can be profitable, it requires a thorough understanding of market dynamics, strict discipline and the ability to make quick decisions in the face of market fluctuations.

Required tools and platforms for scalping

The right set of tools and a reliable trading platform are essential components of successful scalping. Technical indicators and advanced charting tools are your best allies. Not just any indicator will do, you need accurate tools that react quickly to market changes:

- Moving averages: Fast-changing averages such as the EMA (exponential moving average) are popular among scalpers for identifying trends on the shortest time frames;

- Bollinger Bands: This tool helps to understand market volatility. Scalpers use Bollinger Bands to catch quick price movements and identify overbought or oversold conditions;

- Stochastic Oscillator: Ideal for identifying potential pivot points, indicating overbought and oversold levels;

- Relative Strength Index (RSI): A momentum oscillator that helps scalpers determine the speed and change in price movements;

- MACD (Moving Average Convergence Divergence): Useful for determining the direction of market trends and momentum;

- Time Frames: Typically, scalpers focus on short time frames such as 1-minute (M1), 5-minute (M5) or 15-minute (M15) charts. These time frames provide the necessary detail to catch small movements in the market.

Best Forex pairs for scalping in 2024

In 2024, certain pairs stand out for their suitability for scalping due to liquidity, volatility and market dynamics. Scalpers must understand these characteristics in order to effectively capitalise on small price movements. Traders often divide currency pairs into three groups: major, minor and exotic. Each category has its own unique traits that can influence a scalper's decision.

Major pairs include the world's most traded currencies, such as EUR/USD, GBP/USD and USD/JPY. They are known for their high liquidity, narrow spreads and more predictable price movements, making them ideal for scalping. The high trading volume in these pairs results in smoother and more frequent price movements, which is favourable for making small profits. Minor pairs do not include the US dollar, but are linked to other major currencies such as EUR/GBP or AUD/JPY. Although they offer less liquidity than major pairs, they can exhibit larger price movements, which can be favourable for scalpers looking for a slightly higher risk-reward ratio.

Exotic pairs involve a major currency paired with a developing country currency, such as USD/TRY or EUR/ZAR. Exotic pairs are characterised by lower liquidity and higher spreads, but can also have significant volatility. This can be a double-edged sword for scalpers: while the potential for large profits exists, there is also the risk of large losses.

Risk management in scalping

With effective risk management, when many trades are made throughout the day, even small slip-ups can turn into significant losses. One of the most important risk management tools for scalpers is the stop loss order. This tool helps to limit potential losses by automatically closing a position at a predetermined price. Scalpers place tight stop loss orders because of the small profit margin per trade, which requires precision in placing them.

Managing the size of each trade is another important aspect of risk management in scalping. Scalpers often use a small percentage of their total account balance for each trade to ensure that a single loss does not have a significant impact on their account. It is also very important for scalpers to stay abreast of news and market events in real time. Sudden changes in the market can have a significant impact on scalping strategies, and the ability to react quickly to news or economic events can be the difference between profit and loss.

Leveraged scalping

Leverage is a powerful tool in scalping that can increase profits but also amplify losses. Leverage allows scalpers to trade larger positions with a smaller amount of actual capital. While this can increase profit potential on small price movements, it also increases risk as losses are also magnified. The key to using leverage in scalping is balance. Scalpers should assess their risk tolerance and set a level of leverage that suits their strategy and comfort level. It is critical to avoid excessive leverage as the fast-paced nature of scalping can lead to rapid losses.

A well-planned leverage strategy includes a clear understanding of margin requirements and the potential impact on the trading account. Scalpers should always have a clear exit strategy for each trade and be prepared to act quickly if the market moves against them.

Conclusion

Forex scalping is a unique trading strategy that requires a combination of technical knowledge, psychological resilience and a willingness to continuously learn. This strategy can be highly profitable for those who are willing to invest time and effort in developing the necessary skills and discipline. However, it is important to remember that scalping carries significant risks and requires strict risk management. Continually improving their skills and adapting to market changes will help traders maximise the benefits of this strategy.

FAQ

What is Forex scalping?

Forex scalping is a trading strategy that involves making many trades quickly throughout the day to capitalise on small short-term market fluctuations.

What personal qualities are needed to be a successful scalper?

Survival under pressure, high level of concentration, discipline, agility, technological savvy, market understanding, patience, mental and physical stamina, risk tolerance and eagerness to learn are essential for successful scalping.

Is Forex scalping profitable?

Scalping can be profitable, but it also carries significant risks. Successful scalping requires strict risk management, discipline and consistent application of strategies.

What tools and platforms are needed for scalping?

Accurate technical indicators and advanced charting tools such as moving averages, Bollinger Bands, stochastic oscillator, RSI and MACD are necessary. It is important to choose reliable trading platforms.

Which currency pairs are suitable for scalping in 2024?

The best pairs for scalping include major pairs (EUR/USD, GBP/USD, USD/JPY), minor pairs (EUR/GBP, AUD/JPY) and exotic pairs (USD/TRY, EUR/ZAR) because of their liquidity, volatility and market dynamics.

Reviews