Comprehensive Review of Traddoo: Services, Pros, and Cons

Explore a neutral review of Traddoo, covering its services, advantages, and disadvantages. Understand why this trading platform has a low Scam Detector score and limited legal information.

Верните переведенные деньги прямо сейчас!

30.07

Share Article

Traddoo is a trading platform that offers real capital and daily payouts to its users. This review aims to provide a detailed analysis of the services offered by Traddoo, along with a balanced list of its advantages and disadvantages. Additionally, we will explore why the platform has a low Scam Detector score and limited legal information, as well as its suspicious social media profiles.

Detailed Analysis of Services

Traddoo offers a comprehensive range of services to help traders maximize their potential. One of its standout features is the provision of real capital, allowing traders to withdraw their profits daily, typically within an average of 8 hours. This quick access to earnings is particularly beneficial for those who prefer immediate liquidity.

The platform is also noted for its built-in scaling programs, which provide complete transparency from the initial investment to the payout stage. This transparency ensures that traders are always aware of their progress and potential earnings. Additionally, all allocations on Traddoo are live capital, meaning traders can withdraw their funds at any time, offering significant flexibility for active investment management.

Traddoo operates on an 80/20 profit split, allowing traders to retain 80% of their profits. Moreover, the platform offers a 100% refundable fee upon passing stage 2 of their challenge, reducing the financial risk for traders. Custom-built Expert Advisors (EAs) are available to help traders optimize their strategies and manage risks effectively.

Consistently achieving a 10% profit target makes traders eligible for a 50% balance increase every three months, incentivizing high performance. Traddoo also ensures direct market execution in a live trading environment and provides industry-leading spreads from top providers, offering competitive rates and efficient trade execution.

However, it is important to be aware of the high risks associated with trading CFDs (Contracts for Difference). With 71% of retail investors losing money when trading CFDs with Traddoo, the inherent risks of CFD trading should be carefully considered.

Advantages of Traddoo

- Quick Payouts: The ability to withdraw profits daily with an average payout time of 8 hours is a significant advantage for traders who need quick access to their funds.

- Transparency and Scaling Programs: The built-in scaling programs and full transparency from investment to payout provide traders with a clear understanding of their progress and potential earnings.

- Flexible Capital Management: The option to withdraw live capital at any time offers traders flexibility in managing their investments.

- High Profit Retention: The 80/20 profit split allows traders to retain a substantial portion of their earnings.

- Refundable Fees: The 100% refundable fee upon passing stage 2 of the challenge reduces the financial risk for traders.

- Advanced Trading Tools: The availability of custom-built EA's for trading and risk management helps traders optimize their strategies.

- Incentives for High Performance: The 50% balance increase every three months for achieving a 10% profit target incentivizes traders to maintain high performance.

- Competitive Trading Conditions: Direct market execution and industry-leading spreads ensure efficient trade execution and competitive rates.

Disadvantages of Traddoo

- High Risk of CFD Trading: The high risk associated with trading CFDs, with 71% of retail investors losing money, is a significant disadvantage.

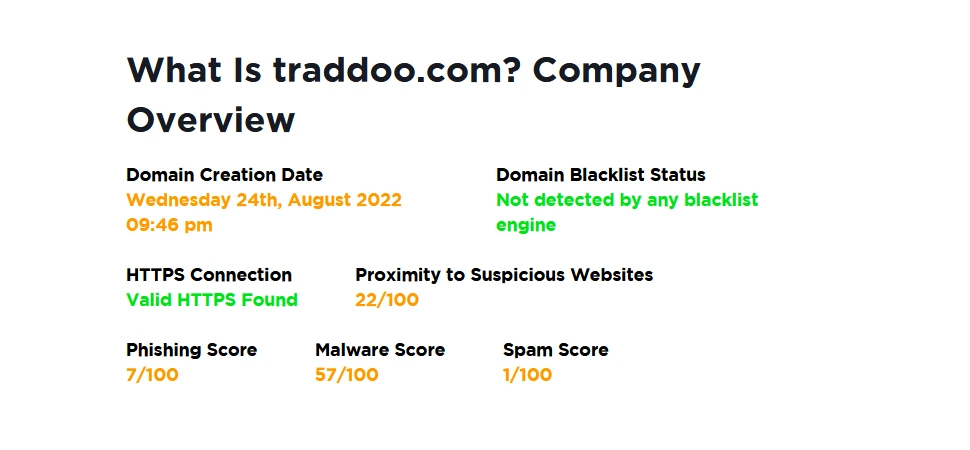

- Low Scam Detector Score: Traddoo has a very low Scam Detector score of 17.8, which raises concerns about its credibility and trustworthiness.

- Limited Legal Information: The website provides very little legal information, which can be a red flag for potential users seeking transparency and security.

- Suspicious Social Media Profiles: The company's social media profiles appear suspicious, which may deter potential users from trusting the platform.

Conclusion

Traddoo offers a range of services designed to support traders, including real capital, daily payouts, and advanced trading tools. The platform's transparency, flexible capital management, and high profit retention are notable advantages. However, the high risk of CFD trading, low Scam Detector score, limited legal information, and suspicious social media profiles are significant disadvantages that potential users should consider. This neutral review aims to provide a balanced perspective on Traddoo, helping readers make informed decisions about using the platform.

Как же выполнить возврат денежных средств от "Брокер-Мошенник"

Существуют специально созданная нами организация с командой опытных экспертов и юристов, которые смогут

доказать, что "Брокер-Мошенник" является мошеннической на основе собранных опросов, проверок и отзывов

клиентов.

Без предоплат, бюрократии и в минимальные сроки они докажут, что потерянные в результате мошенничества

деньги принадлежат вам и осуществят возврат средств.

Запишитесь на бесплатную консультацию

Как происходит возврат денег от "Брокер-Мошенник"?

1

Оформление заявки на консультацию

2

Оценивание возможностей и перспектив юристами по возврату

3

Разработка плана и выбор стратегии

4

Переговоры с недобросовестной компанией

5

Ожидание возврата денег на карту или счет

Reviews